QQQI dividend history shows how this fund has rewarded its investors over time. Understanding QQQI dividend history can help you make smart decisions about buying or holding this fund. Investors often look at past dividends to predict future returns. By checking QQQI dividend history, you can see patterns in payment schedules, growth rates, and overall performance. This information is useful not just for beginners but also for experienced investors who want to manage their portfolios better. Dividends are an important part of total returns, and knowing QQQI dividend history helps you plan for long-term financial goals, like retirement or building passive income. Keeping track of QQQI dividend history also shows how the fund reacts in different market conditions, giving you a clear picture of its reliability and consistency over time.

When we look deeper into QQQI dividend history, we notice that the fund pays dividends regularly, usually on a quarterly basis. Investors can use QQQI dividend history to calculate their expected income and reinvest it for compounding growth. QQQI dividend history is not just numbers—it tells a story of the fund’s financial health and management strategy. By studying QQQI dividend history, you can compare it with other similar funds and decide which investment fits your goals best. Historical data shows trends in dividend growth, and understanding QQQI dividend history helps you see how it might perform in the future. This is especially helpful for people who depend on dividends as part of their monthly income or want to grow their investment steadily. Keeping an eye on QQQI dividend history ensures that your investment choices are informed and backed by real data.

QQQI Dividend History: A Complete Guide for Smart Investors

QQQI dividend history is an important resource for anyone looking to invest in this fund. By studying QQQI dividend history, investors can understand how this fund has paid dividends over the years. Dividends are a key part of investment returns, and knowing QQQI dividend history helps you plan for steady income and long-term growth. Investors often check dividend patterns to predict how a fund might perform in the future. QQQI dividend history shows the consistency of payments, the growth trends, and how market conditions affect returns. This knowledge is useful for both new and experienced investors who want to make informed decisions and grow their wealth smartly.

Looking closely at QQQI dividend history, we see that it usually pays dividends quarterly. Studying QQQI dividend history allows investors to calculate expected income and even reinvest dividends for compounding growth. But QQQI dividend history is more than numbers—it reveals the fund’s financial health and management strategy. Understanding these trends helps you compare QQQI with other funds and choose the best fit for your investment goals. Historical data shows how dividends have grown, helping investors make future predictions. QQQI dividend history is essential for people seeking stable income or long-term wealth building. Tracking this history ensures your investment choices are backed by real, reliable data.

Understanding QQQI Dividend History: Basics You Need to Know

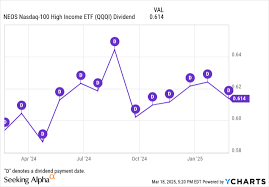

QQQI dividend history is the record of all dividend payments the fund has made to its investors. Dividends are portions of the fund’s profits shared with shareholders. By checking QQQI dividend history, you can see when dividends were paid, how much was paid, and whether there are trends of increasing or decreasing payments. This helps you plan your investment strategy.

Investors often look at QQQI dividend history to understand the fund’s stability. If a fund has a steady dividend record, it suggests good management and reliable performance. QQQI dividend history also allows investors to make predictions about future payouts. For anyone new to investing, this can be a helpful guide to know what to expect.

How QQQI Dividend History Can Help Investors Make Decisions

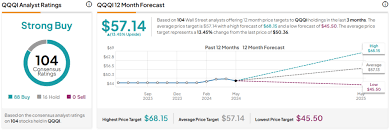

QQQI dividend history provides insight into the fund’s overall performance. By studying the past, investors can make smart decisions about buying, holding, or selling. For example, if QQQI dividend history shows consistent growth, it may indicate that the fund is healthy and reliable.

Investors also use QQQI dividend history to compare it with other similar funds. This helps them choose the best option for their financial goals. QQQI dividend history can also show how the fund reacts during market ups and downs, giving investors a clear idea of its risk and reliability.

Quarterly Payouts: A Look at QQQI Dividend History Patterns

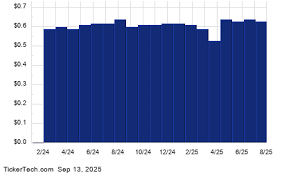

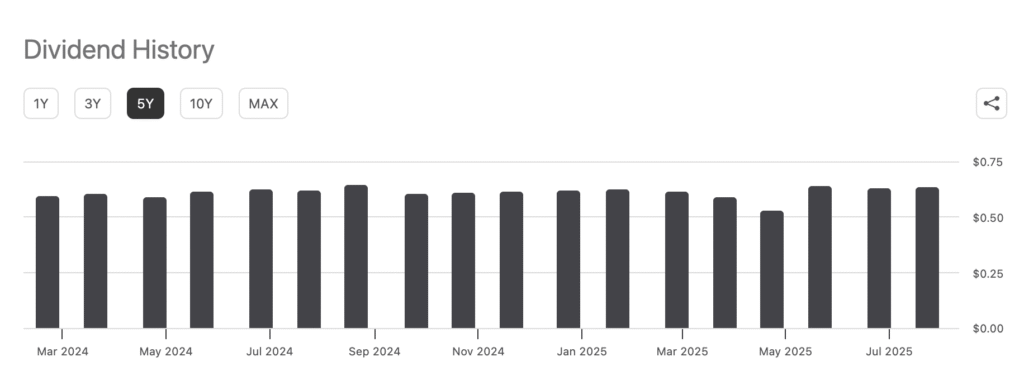

QQQI dividend history shows that the fund usually pays dividends every three months. This is called a quarterly payout. By reviewing QQQI dividend history, investors can identify trends in these payments. For example, some quarters might have higher payouts due to market conditions or fund performance.

Tracking QQQI dividend history helps investors plan their income. Those who rely on dividends for regular cash flow can use this information to budget or reinvest in the fund. Quarterly payout patterns are an essential part of QQQI dividend history that helps make future planning easier.

Tracking QQQI Dividend History: Tools and Tips

You don’t have to track QQQI dividend history manually. Several online tools and websites provide historical dividend data for this fund. By checking these tools regularly, investors can stay updated on past and upcoming payments.

When tracking QQQI dividend history, note the payment dates, amounts, and changes over time. This gives you a clear picture of how reliable the fund is. Some investors even use spreadsheets to track their income and growth from dividends. QQQI dividend history becomes much more useful when paired with smart tracking and analysis.

Dividend Growth Insights from QQQI Dividend History

One of the key benefits of studying QQQI dividend history is understanding growth trends. Over time, many funds increase their dividend payouts. By looking at QQQI dividend history, investors can see if the fund has a pattern of raising dividends regularly.

This insight is important for long-term investors. Funds that consistently increase dividends can provide growing income over time. Using QQQI dividend history to analyze these trends helps investors make smarter decisions about reinvesting and planning for the future.

QQQI Dividend History vs Other Funds: What Makes It Unique

QQQI dividend history can be compared with other funds to see how it stands out. Some funds may pay higher dividends but less consistently, while QQQI may offer steady payouts with moderate growth.

By reviewing QQQI dividend history alongside other funds, investors can make informed choices. They can weigh the pros and cons of each option based on stability, growth, and reliability. QQQI dividend history is a key tool for anyone seeking a balanced investment strategy.

Reinvesting Dividends Using QQQI Dividend History Data

Reinvesting dividends is a strategy to grow your investment faster. By studying QQQI dividend history, investors can plan how to reinvest payouts effectively. For example, if QQQI dividend history shows regular quarterly payments, reinvesting these amounts can lead to compounding growth.

Reinvestment helps build wealth over time. Using QQQI dividend history as a guide, investors can decide the best times to reinvest and maximize returns. It is a smart way to use historical data to enhance future gains.

FAQs

Q1: How often does QQQI pay dividends?

QQQI typically pays dividends every quarter, making it easier for investors to plan their income.

Q2: Can I predict future dividends from QQQI dividend history?

While past performance doesn’t guarantee future results, QQQI dividend history provides useful trends and patterns for predictions.

Q3: Should I reinvest QQQI dividends?

Reinvesting dividends can help grow your investment over time. Studying QQQI dividend history helps decide the best approach.

Q4: Is QQQI dividend history important for beginners?

Yes! QQQI dividend history shows consistency, trends, and growth, which helps beginners make informed investment decisions.

Q5: How can I track QQQI dividend history easily?

You can use online financial platforms, fund websites, or personal spreadsheets to track QQQI dividend history accurately.

Conclusion

QQQI dividend history is a vital tool for investors seeking steady income and long-term growth. By studying past payments, patterns, and trends, you can make informed decisions about buying, holding, or reinvesting in this fund. Tracking QQQI dividend history helps understand the fund’s reliability, growth potential, and overall performance. Whether you are a beginner or an experienced investor, using QQQI dividend history can guide your strategy, plan your income, and maximize returns over time.